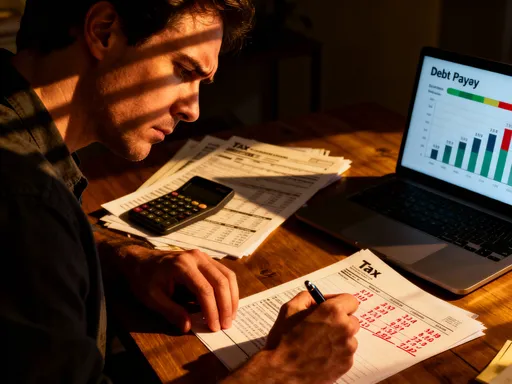

How I Slashed My Debt Faster with Smarter Tax Moves

Paying off debt can feel like running on a treadmill—lots of effort, but slow progress. I was stuck too, until I realized I’d been ignoring a hidden tool: tax optimization. It’s not about dodging taxes—it’s about using the system wisely. By aligning debt repayment with smart tax strategies, I cut costs, boosted cash flow, and accelerated my freedom. This is how I did it, and how you can too—legally, ethically, and effectively. What began as a personal breakthrough has become a repeatable framework, one that transforms the way ordinary people manage money. The truth is, most of us pay more in taxes than we need to, and that extra money often goes unnoticed—until it’s gone. But when you start seeing tax planning not as a chore, but as a strategic lever, everything changes. You gain breathing room. You gain momentum. And most importantly, you gain control.

The Debt Trap That Felt Impossible to Escape

For years, I lived under the weight of debt without fully understanding why I couldn’t get ahead. I made every payment on time, avoided new charges, and even cut back on groceries and entertainment. Still, my balances barely moved. Month after month, I watched most of my payment go toward interest, not the principal. The frustration was constant, and the emotional toll was real. I felt trapped, as if no matter how hard I worked, the system was designed to keep me stuck. Looking back, the real issue wasn’t just high interest rates or low income—it was a lack of coordination between my financial actions and the tax code. I was repaying debt with money that had already been taxed, missing opportunities to reduce my tax burden and redirect those savings toward what mattered most: freedom from debt.

It wasn’t until I took a full inventory of my finances that I began to see the gaps. I had never considered how much I was overpaying in taxes simply because I didn’t claim available deductions or time my payments strategically. I was treating my tax return as a windfall rather than a planning tool. That shift in mindset—seeing taxes not as a fixed cost but as a variable one—was the turning point. I started asking questions: Could I lower my taxable income legally? Were there types of debt whose interest could reduce what I owed? Was there a better way to use my tax refund than spending it on everyday expenses? These weren’t radical ideas, but they were ones I had overlooked because I assumed tax planning was only for the wealthy or self-employed. The reality is, tax-smart strategies are accessible to anyone who files a return, and they can make a meaningful difference in the pace of debt repayment.

What finally pushed me to act was realizing that every dollar I overpaid in taxes was a dollar I couldn’t use to pay down debt. That meant I was effectively borrowing from myself at a high interest rate—my own tax inefficiency was costing me money. Once I saw that connection, I committed to learning how the system worked and how I could use it to my advantage. This wasn’t about gaming the system; it was about playing by the rules more effectively. And the first step was understanding the difference between tax evasion and tax optimization—a distinction that many people still confuse today.

Tax Optimization Isn’t Tax Evasion—Here’s the Difference

One of the biggest barriers to smarter tax planning is fear. Many people avoid exploring tax-saving strategies because they worry about breaking the law. But there’s a crucial difference between tax evasion—which is illegal—and tax optimization, which is not only legal but encouraged by the tax code itself. Tax optimization means using every legitimate deduction, credit, and timing strategy available to reduce your taxable income. It’s what accountants do for their clients, what businesses do every quarter, and what smart individuals do to keep more of their hard-earned money. The IRS doesn’t punish people for minimizing their tax liability within the rules; in fact, the structure of the tax code assumes that taxpayers will take advantage of available benefits.

I learned this the hard way when I first started researching deductions. I was hesitant to claim anything beyond the standard deduction, worried that the IRS might see me as suspicious. But after speaking with a tax professional, I realized that not claiming what I was entitled to was like leaving money on the table. The tax code is full of incentives—education credits, retirement contributions, healthcare savings, and more—designed to reward certain behaviors. By ignoring them, I was missing out on hundreds, even thousands, of dollars each year. The key is documentation and accuracy. As long as you report truthfully and keep proper records, there’s no risk in taking deductions you qualify for.

One of the most powerful concepts I discovered was the idea of above-the-line deductions—adjustments to income that reduce your adjusted gross income (AGI) before you even reach the standard or itemized deduction stage. Things like contributions to a traditional IRA, student loan interest (up to certain limits), and self-employed health insurance premiums can all lower your AGI, which in turn can make you eligible for other credits and benefits. Lower AGI can also affect things like Medicaid eligibility, marketplace insurance subsidies, and even the taxation of Social Security benefits down the road. For someone in debt, even a small reduction in taxable income can free up cash that can be redirected toward repayment.

Another strategy I adopted was tax-deferred growth through retirement accounts. While you can’t use a 401(k) or IRA to directly pay off credit card debt without penalties, the tax savings from contributing to these accounts can increase your take-home pay or reduce your tax bill, giving you more flexibility in your budget. For example, if you’re in the 22% tax bracket and contribute $5,000 to a traditional IRA, you could reduce your taxable income by that amount, potentially saving over $1,000 in taxes. That $1,000 isn’t lost—it’s available to use elsewhere, including debt repayment. The same principle applies to employer-sponsored plans. By adjusting my withholding and maximizing my 401(k) contributions, I lowered my tax burden and created room in my monthly cash flow to attack debt more aggressively.

How I Used Deductions to Fuel My Debt Payoff

One of the most eye-opening discoveries in my journey was learning that not all debt is created equal from a tax perspective. While credit card interest is not deductible, other forms of interest can be. For example, interest paid on student loans—up to $2,500 per year—is deductible, subject to income limits. That means if you’re paying $1,800 in student loan interest annually, you can reduce your taxable income by that amount, potentially saving hundreds in taxes. I had been treating all my debt the same, making equal payments across the board, without considering which debts offered tax advantages. Once I realized this, I adjusted my strategy.

I refinanced part of my high-interest credit card debt into a home equity line of credit (HELOC) for home improvements, which allowed me to deduct the interest under certain conditions. The IRS allows taxpayers to deduct interest on home equity debt if the funds are used to buy, build, or substantially improve the home that secures the loan. This is a critical distinction—using a HELOC for vacations or daily expenses doesn’t qualify. But because I used the funds to renovate my kitchen, I was able to treat the interest as tax-deductible mortgage interest, subject to limits. This lowered my effective interest rate and reduced my tax bill at the same time. It wasn’t a loophole—it was using the rules as intended.

Proper documentation was essential. I kept receipts, contracts, and bank statements showing that the HELOC funds were used exclusively for qualifying improvements. I also consulted a tax advisor to ensure I met all requirements. The result? I saved over $400 in taxes the first year and redirected that amount toward my highest-interest debt. It wasn’t a huge sum, but it was consistent, and it gave me momentum. I also began tracking my student loan interest more carefully, ensuring I received the correct Form 1098-E from my lender each year. Even small deductions add up, especially when you’re working with tight margins.

Another area I explored was the potential tax benefit of business-related debt. While I wasn’t self-employed at the time, I later started a small side business from home. That opened up new opportunities—business loans, equipment purchases, and home office expenses could all generate deductions. Even if you have a modest side income, structuring it properly can create tax-saving opportunities that free up cash for debt repayment. The key is to keep business and personal finances separate and maintain clear records. Again, this isn’t about avoiding taxes—it’s about organizing your finances in a way that aligns with the incentives the tax code provides.

Timing Is Everything: Syncing Repayments with Tax Seasons

Before I changed my approach, I made the same debt payment every month—steady, predictable, and painfully slow. Then I realized I was missing a powerful opportunity: timing. Most people receive a tax refund in the spring, often without planning how to use it. According to the IRS, the average refund in recent years has been over $2,500. That’s a significant sum, especially for someone trying to pay down debt. Instead of spending it on household items or a vacation, I decided to use mine as a strategic debt reduction tool.

I started treating my tax refund not as extra money, but as a planned installment in my debt payoff strategy. I projected my expected refund based on the previous year’s return and adjusted my withholding slightly to ensure I wouldn’t overpay too much during the year—avoiding an interest-free loan to the government. Then, I committed that entire amount to my highest-interest debt. The impact was immediate. A single $2,500 payment on a credit card with a 19% interest rate could save hundreds in interest over time and shorten the payoff timeline by months, even years. It was like giving myself a financial jump-start every spring.

But I didn’t stop there. I also began aligning other windfalls with my debt goals. Year-end bonuses, holiday gifts, rebates, and even stimulus payments were all treated as debt reduction opportunities. I set up a separate savings account to hold these funds temporarily, so they wouldn’t get mixed into my regular spending. This created a psychological barrier—I was less likely to spend money I had already mentally assigned to debt. Over time, this practice turned occasional windfalls into predictable debt attacks. I also started reviewing my repayment schedule annually, adjusting it based on expected tax refunds and other income changes.

Another timing strategy I adopted was front-loading my debt payments. Instead of spreading payments evenly, I used my refund to make a large payment early in the year, which reduced my principal balance and, in turn, the amount of interest I would accrue over the rest of the year. This is a simple application of compound interest working in my favor, rather than against me. The earlier you reduce the principal, the more you save in interest. By syncing my largest payments with my tax season, I turned a passive event—filing taxes—into an active financial strategy.

Choosing the Right Accounts: Tax-Advantaged Tools That Help

One of the most overlooked aspects of debt repayment is the role of tax-advantaged accounts. While these accounts don’t directly pay off debt, they reduce your tax burden, which increases your disposable income. That extra cash can then be used to accelerate debt repayment. Two of the most powerful tools in this category are Health Savings Accounts (HSAs) and retirement accounts like traditional IRAs and 401(k)s.

I started contributing to an HSA after switching to a high-deductible health plan. The triple tax advantage of an HSA—tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses—made it one of the most efficient accounts available. Even though I wasn’t using the funds immediately for medical bills, I was building a reserve that reduced my taxable income now. That meant a smaller tax bill and more room in my budget. Over time, I redirected the savings from lower taxes into my debt repayment plan. The HSA also served as a secondary emergency fund, reducing the need to rely on credit cards for unexpected health expenses.

Likewise, I maximized my contributions to my employer’s 401(k) up to the match, effectively earning free money while lowering my taxable income. I then increased my traditional IRA contributions, further reducing my AGI. These moves didn’t eliminate my debt overnight, but they created a steady stream of tax savings that I could leverage. The key was discipline—using the savings to pay down debt, not to increase lifestyle spending. I also avoided withdrawing from these accounts prematurely, as early withdrawals can trigger taxes and penalties that would undermine my progress.

For self-employed individuals or those with side income, a Simplified Employee Pension (SEP) IRA or Solo 401(k) can offer even higher contribution limits and greater tax benefits. These tools aren’t just for retirement—they’re part of a broader financial strategy that improves cash flow today. By reducing what you owe the government, you increase what you can allocate to debt. The result is a virtuous cycle: lower taxes, more cash flow, faster debt repayment, and greater financial stability.

The Risks and Rules: Staying Safe While Optimizing

As I became more confident in my tax strategies, I also became aware of the risks. The IRS has clear rules, and crossing the line—even unintentionally—can lead to audits, penalties, and interest charges. I learned this when I considered converting credit card debt into a mortgage-style loan without proper documentation. While the interest might have been deductible, the IRS requires that the funds be used for qualifying home improvements. Mixing personal and deductible expenses is a common mistake, and one that can invalidate a deduction.

I also realized the importance of record-keeping. Deductions for home equity loans, business expenses, or medical costs require documentation. I started saving digital copies of receipts, contracts, and bank transfers, organizing them by category and year. I used accounting software to track deductible expenses and reviewed everything before filing. This not only protected me in case of an audit but also gave me confidence that I was claiming only what I was entitled to.

Another pitfall I avoided was chasing aggressive tax strategies without understanding the rules. Some online forums promote questionable methods, like inflating home office deductions or claiming personal travel as business expenses. These are red flags for the IRS. I made a rule for myself: if a strategy feels too good to be true, it probably is. Instead, I focused on well-established, widely accepted practices that had clear guidance from the IRS.

I also began consulting a tax professional annually, especially as my financial situation evolved. A qualified CPA or enrolled agent can spot opportunities I might miss and ensure I stay compliant. The cost of professional advice is often far less than the cost of a mistake. Tax optimization should reduce stress, not increase it. By staying within the rules, keeping clean records, and seeking expert guidance when needed, I was able to use tax strategies safely and effectively.

Building a System That Works Long-Term

What started as a one-time effort to pay off debt has become a permanent part of my financial life. I now plan my tax strategy and debt repayment together, treating them as interconnected goals rather than separate tasks. Every year, I follow a simple cycle: I review my deductions, forecast my income, adjust my withholding, and allocate expected windfalls—including my tax refund—toward debt or savings. This annual rhythm keeps me proactive rather than reactive.

I also track my progress visually, using a debt payoff chart and a tax savings log. Seeing the numbers improve over time reinforces my commitment. I’ve learned that consistency matters more than perfection. I don’t always maximize every deduction, and I’ve made mistakes along the way. But by staying focused on the principles—reduce taxable income legally, use savings to pay down debt, and avoid unnecessary risks—I’ve built lasting financial resilience.

The most important lesson I’ve learned is that financial freedom isn’t about earning more—it’s about keeping more. Tax optimization isn’t a shortcut; it’s a smart, disciplined approach to managing money. By aligning debt repayment with tax planning, I turned a frustrating grind into a strategic journey. And the best part? These strategies are available to anyone who files a tax return. You don’t need a high income or a finance degree. You just need awareness, intention, and the willingness to learn. With those, you can take control of your finances—one smart move at a time.